Tuesday, December 22, 2009

Macroeconomics Take-Home Exam: 2009 Crisis Version

Monday, December 21, 2009

Happy Holidays everyone!

Monday, December 14, 2009

How to know you are from a civilized country - Instrumental Variables proposal

R.I.P - Paul Samuelson

My first textbook in college was his classic "Economics" and I'll never forget talking about "guns and butter" when talking about resource allocation.

Let his soul rest in peace.

Wednesday, December 2, 2009

New Paper!

Here is the link if you're interested:

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1509650

Comments are more than welcome!

Tuesday, November 24, 2009

Things I Love about Work

Tuesday, November 17, 2009

Stress is Bad for your Trading Account

Here is a video of how it should work. It looks like really good sci-fi stuff. I wonder if it might help in other situations, like preparing to an interview, approaching girls, or right before some World Cup penalty shoot-out...

Saturday, November 14, 2009

Perspective

One of the great mysteries of life is how molecules combined over and over again until it evolved to sentient life. If this isn't a good reason to believe in God, I don't know what else could be.

Wednesday, November 4, 2009

Chance Favors the Prepared Mind

Monday, November 2, 2009

Terminator and Real Options

Monday, October 26, 2009

Weak Dollar

In class we discussed many things::

- Recent decreases in risk aversion reversed the "flight to quality" seen during the peak of the crisis.

- Bad monetary and fiscal policy by the Fed and the US Treasury relative to other countries (aka higher inflation).

- Sovereign governments diversifying their reserves to securities in other currencies.

Saturday, October 24, 2009

GFC and bonuses

Next week I'll discuss options in class. I think I will use this as an example to talk about puts.

PS - The first time I read GFC I thought it was something like the "Global Fighting Championship" rather than "Global Financial Crisis"...

Friday, October 16, 2009

Why is it so difficult for foreign firms to suceed in China?

The article says that firms "... they complain about subsidized competition, restricted access, conflicting regulations, a lack of protection for intellectual property and opaque and arbitrary bureaucracy."

I wonder whether China will ever open their domestic market enough to enable serious competition by foreign firms.

Thursday, October 15, 2009

Perfect Memory

Here is the introduction of the article:

The Californian, who has an almost perfect memory, is trying to describe how it feels. She starts with a small demonstration of her ability. "When were you born?" she asks.

She hears the date and says: "Oh, that was a Wednesday. There was a cold snap in Los Angeles two days later, and my mother and I made soup."

Tuesday, October 13, 2009

Ig Nobel prizes

Sunday, October 11, 2009

Cloud Computing and Data Loss

Thursday, October 8, 2009

Light Blogging

Hopefully the weekend won't be as busy!

Saturday, October 3, 2009

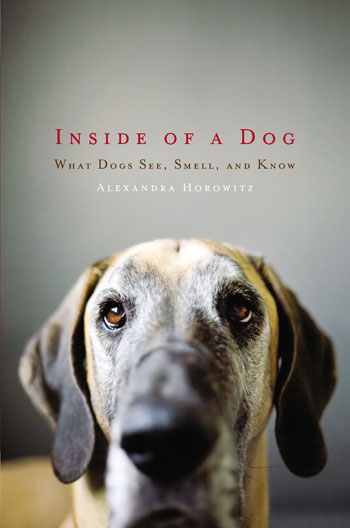

It's a Dog's World

Not only are we not always smelling, but when we do notice a smell it is usually because it is a good smell, or a bad one: it's rarely just a source of information. We find most odors either alluring or repulsive; few have the neutral character that visual perceptions do. We savor or avoid them. My current world seems relatively odorless. But it is most decidedly not free of smell. Our own weak olfactory sense has, no doubt, limited our curiosity about what the world smells like. A growing coalition of scientists is working to change that--and what they have found about olfactory animals, dogs included, is enough to make us envy those nose-creatures. As we see the world, the dog smells it. The dog's universe is a stratum of complex odors. The world of scents is at least as rich as the world of sight. "

Friday, October 2, 2009

100 best blogs for MBA students

If any of my students read this, I hope you find it useful!

Thursday, October 1, 2009

Teaching Duties...

Tuesday, September 29, 2009

Stereotyping

Sunday, September 27, 2009

Worst Investor Award

The Economist this week reports a fun contest sponsored by Hedgeable.com: who was America's worst investor during the crisis?

The Economist this week reports a fun contest sponsored by Hedgeable.com: who was America's worst investor during the crisis?Thursday, September 24, 2009

5...4...3...2...1 ...

The ratio of public debt to total GDP in Brazil is expected to grow from 37.1% in 2008 to 44.5% in 2011, which doesn't look that bad.

The US is expected to go from 39% to 66%, which doesn't look that good, specially against its long term average.

The really scary number is for the UK, whose debt is expected to grow from 49% to 93% of GDP.

These clearly show the different efforts made by governments to rescue their economies. I expect that people in the UK are very likely to face either tax rises or big decreases in public services expenditures in the near future.

Wednesday, September 23, 2009

World War II & Protectionism

On a different take than most WWII books, the author tries to view the conflict through an economics point of view. Something that drew my attention is how the Great Depression had a significant impact on international affairs during the 30s. In particular, I found incredible how the protectionist measures taken by individual countries (i.e. the usual "beggar-thy-neighbor" policies) ended up making life much more difficult to people in terms of reducing international trade and having domestic production of clearly inefficient goods.

I wish that leaders from the G20 take up the opportunity and give the Doha Round on multilateral trade another go.

Monday, September 21, 2009

Are you happy with financial markets?

To be honest, even if we get to "No" and then "Yes", I have a feeling that we still won't be happy with outcome given the current changes that have been implemented.

I think that people are thinking that we can push implementing measures

Sunday, September 20, 2009

A Defense of Modern Macroeconomics

This article by Narayana Kocherlakota (U Minnesota) makes a defense of current macroeconomics models and try to counter some of the criticisms. I agree with most arguments, but I still think that many people over-relied in models that were clear simplifications of reality.

As he mentions in the article that I also agree, one of the consequences of the crisis will be to open new avenues of research to Econ and Finance professors, having showed us the importance of some characteristics (specially institutional) that were overlooked and should be essential parts of models.

Tuesday, September 15, 2009

Different Bear Markets over Time

It is really amazing how big the Great Depression was. It must have been tough to live it through...

Sunday, September 13, 2009

State of Macroeconomics

I'm not saying anything new here, but a big part of the problem is that many models push aside the role of financial markets and the importance of imperfections out there. Of course simplifying assumptions have to be made in order to help our understanding of the world, but sometimes people get carried away and take their models too seriously.

Well, I hope we at least learn something for the next crisis. It's much easier to do empirical than theoretical work these days!

Saturday, September 5, 2009

Will Electric Cars Become a Disruptive Technology?

The Economist this week has an interesting article discussing if electric cars will turnout to be a "disruptive technology" and forever change how our cars are powered.

The Economist this week has an interesting article discussing if electric cars will turnout to be a "disruptive technology" and forever change how our cars are powered.Something I'm curious to know is what companies (from Apple to Bosch to Honda) do with batteries after they die. Can they recycle the chemical components into other batteries and/or useful things?

Friday, September 4, 2009

So Close... And Yet So Far

Avanidhar Subrahmanyam has just released a paper on SSRN in which he reviews many variables and methods that people have used to predictor returns (like P/E, size, liquidity, etc.)

He writes "our learning about the cross-section is hampered when so many predictive variables accumulate without any understanding of the correlation structure between the variables, and our collective inability or unwillingness to adequately control for a comprehensive set of variables."

With so many people, testing so many variables, with so many different methods, it is often difficult to really know whether a given variable can truly predictive future returns or it is just reflecting correlation with something else.

It would be nice to see a paper trying to run a "horse-race"of lots of variables at the same time (I mean a lot, not just 4-5).

PS - The article cited that shows that garbage production in the US is a better proxy for consumption than standard measures is really cool.

Wednesday, September 2, 2009

Let There Be Light!

The picture below shows lights in Eastern Europe in 1992 to 2002. Look how Poland, Slovakia and Hungary (to the left) did much better than the former URSS republics (Moldova, Ukraine and Belarus, on the right)

I love when economists use clever thinking to solve problems! I just which they could do that to solve the crisis ;)

Monday, August 31, 2009

Dutch Disease - Brazilian style

The billion-dollar question is whether Brazil will follow Norway into sensibly using these riches or will be another case of the "Dutch disease". Alas, the government did not make a good start, following the old populist tune of politically exploiting something that will only be operational around 2020-2025. Rather than following the mark established in 1998, which gave a huge boost to oil exploration in Brazil by creating incentives to private-sector investments, it is bringing back the old nationalized system, recapitalizing Petrobras (the Brazilian oil company) and giving it at least a 30% stake in any group exploring the wells.

It is a mistake to change the system. They should just sell licenses to the highest bidder as under the current legislation. This would reduce the CAPEX burden on the company, increase government intake and foster further development of the reserve...

We have a saying in Brazil "De onde menos se espera, daí é que não sai nada mesmo" that can be poorly translated as: "From where you least expect things to happen, this is from where things really won’t be happen"...

I'm pessimistic about raising my (future) children in Brazil.

Friday, August 21, 2009

Presenting your results nicely goes a long way in convincing people

I particularly like this graph showing the size of banks before (in color) and after the crisis (in black). This one further divides banks by countries, which puts in perspective the size of each bank relative to its home country:

Friday, August 14, 2009

Reaching the Summit and Getting Back Safely

I think that mechanisms should be in place that reward managers not only on the upside, but also when they suceed in steering companies through crises.

Tuesday, August 11, 2009

Astrology Blogging: Ibovespa Index

I hate trying to forecast the future (don't all economists do...), but this is something that I find odd. Below is the latest graph on the Brazilian stock market index (IBOVESPA) from early 2005. From the 72,000 peak in May-08, the index had fallen more than 50% by Nov-08. Since then, it has gone up by more than 80% and is now around 56,000. The index is about 20% below the probably overoptimistic levels of May-08, but getting close to its value in Jan-08 (still about 10% to go).

My point is: Aren't prices highly overvalued again? Are the prospects for the Brazilian economy really as good now as they were in January 2008? Most of the good news were already known (the new gigantic oil fields, macroeconomic polic stability, etc.). Alas, we now have a bunch of worries on the negative side: smaller domestic growth, big uncertanties about the speed of global recovery, deterioration of public-sector finances, smaller commodity prices upside potential, presidential elections in 2010, etc...

Those that know me, know that I'm no fan of the current goverment and its usual lack of rationality to analysis policy issues (to be honest, almost all). Let's just hope that we are not up for huge disappointment later. If it does, at least I hope it happens before the elections...

What do you think? Am I the pessimist about Brazil? Perhaps living abroad for such a long time has made me even more skeptical...

Wednesday, August 5, 2009

The Internet sometimes dumbs down the world

Such stories are becoming commonplace. A coachload of English schoolchildren bound for the historic royal palace at Hampton Court wasted an entire day battling through congested central London as their sat-nav led them stubbornly to a narrow back street of the same name in Islington. A Syrian lorry driver aiming for Gibraltar, at the southern tip of Spain, turned up 1,600 miles away in the English east-coast town of Skegness, which has a Gibraltar Point nearby.

Two complementary things are happening in these stories. One is that these people are displaying a woeful ignorance of geography. In the case of Stamford Bridge, one driver and two passengers spent well over two hours in a car without noticing that instead of passing Northampton and swiftly entering the built-up sprawl of London, their view continued to be largely of fields and forests, and they were seeing signs for Nottingham, Doncaster and the North. They should have known.

The other is more subtle. Everybody involved in these stories has consciously handed over responsibility for knowing geography to a machine. With the sat-nav on board, they believed that they did not need to know about north or south, Spain or England, leafy Surrey or gridlocked Islington. That was the machine’s job. Like an insurance company with its call centre or a local council with its bin collections, they confidently outsourced the job of knowing this stuff, or of finding it out, to that little computer on the dashboard..."

Friday, July 31, 2009

Geeko is Back... and beating up evil short-sellers

It is funny - or sad, you name it - that the movie is set in London and the villain is a hedge-fund manager. The excesses of the City certainly contributed to this image of London being an over-priced place where traders spend their humongous bonuses over-paying for things. Unfortunately, I don't think that the crisis will improve the city's image. Large bonuses will always be around, on top of London being a magnet for rich people that don't want to go to NY.

More interesting is the bad publicity received by short-sellers during this crisis, which definitely contributed to evil character in the movie using it. Academics (humbly including myself) have shown that short-selling is usually a good thing to markets, even naked short-selling.

However, most investors see it as an unlawful way to make money. People never complain when manipulation drives prices up and short-sellers help to bring them down by bringing information to the markets. Neither they complain about the huge liquidity that short-selles bring to the market (about 30% of total) when they need to sell their holdings. Liquidity that decreased a lot during the SEC ban on short-selling right after Lehman's bankruptcy.

I guess it has to do with the behavioral argument that people hate to talk about negative events... Specially the bad CEOs that blame short-seller for their falling sharing place when it is really ccaused by their own poor management.

Sunday, July 19, 2009

Blaming Liberalization IS NOT Cool

Since my undergrad, I'm a firm believer that governments should intervene as little as possible in private transactions, creating a level playing field for all everyone involved. The current crisis has showed, alas again, that individual excesses can lead to huge systemic risks.

People often mistake deregulation with BAD implementation of deregulation, specially when it is done without proper incentives and institutions to prevent people from gaming the system afterwards. (Note for future-post: Basel II might cause trouble in the future for the same reason).

This reminds me of a similar argument that I often see in the press about the failure of the "neoliberal / Washington Consensus" reforms to improve Latin American countries during the 90s.

You cannot have first-class markets if you do not also develop first-class institutions...

Monday, July 13, 2009

Working vs. Having a Life

Saturday, July 11, 2009

Everything that has a beginning...

At one point during his visit to the Moon, Neil Armstrong realized that he could extend his fist and, using only his thumb, blot out the earth. Asked later if this made him feel like a giant, he said, "No, it made me feel really, really small".

Space exploration has always deeply fascinated me. The infiniteness of the Universe, the fact that ours is just a small planet in the corner of a very ordinary galaxy, the tiny chance that there is a multitude of planets full of people, well, so many mind-boggling things spring to mind whenever I think about it.

People need challenges, long-term goals, dreams! Exploring is, and will always be, a part of us. Be it sending people 20,000 light-years away on a flying casket, researching a new medicine or, in my case, finding out more about financial markets, these are just different ways of searching for the truth.